Small molecule kinase inhibitors approved by the FDA in 2021

- Normal Liver Cells Found to Promote Cancer Metastasis to the Liver

- Nearly 80% Complete Remission: Breakthrough in ADC Anti-Tumor Treatment

- Vaccination Against Common Diseases May Prevent Dementia!

- New Alzheimer’s Disease (AD) Diagnosis and Staging Criteria

- Breakthrough in Alzheimer’s Disease: New Nasal Spray Halts Cognitive Decline by Targeting Toxic Protein

- Can the Tap Water at the Paris Olympics be Drunk Directly?

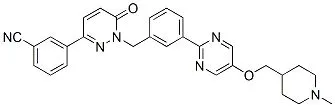

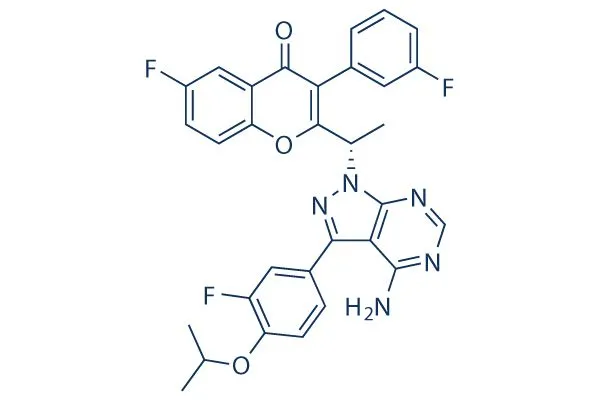

Small molecule kinase inhibitors approved by the FDA in 2021

Small molecule kinase inhibitors approved by the FDA in 2021.

1) February 3, 2021-Tepmetko (tepotinib)-MET

On February 3, Merck Serono’s proto-oncogene protein c-Met inhibitor was again approved by the FDA (accelerated) for the treatment of NSCLC with skipping mutations in exon 14 of MET.

In an open-label clinical trial (NCT02864992), 152 advanced NSCLC patients with MET exon skipping mutations were treated with this product, ORR was 43%, and the median DOR of the subgroup of treated patients (n=83) It was 11.1 months, and the subgroup of newly treated patients (n=69) was 10.9 months.

In NSCLC patients, the incidence of skip mutations in exon 14 of MET is about 3% to 4%.

EVP forecasts sales of US$505 million in 2026.

2) February 5, 2021-Ukoniq(Umbralisib)-PI3K

On February 5, 2021, the FDA accelerated the approval of TG therap’s phosphoinositide-3-kinase (PI3K) inhibitor for use in the treatment of marginal zone lymphoma that has failed/recurred with anti-CD-20 preparations or received at least three Treatment of follicular lymphoma with systemic therapy failure/recurrence.

The FDA approval of this product is based on the preliminary results of two early clinical trials. Trial 1 (NCT02793583) is an open single-arm trial designed for patients with marginal zone lymphoma.

69 patients received the treatment with this product. The ORR rate was 49%, of which CR and PR were 16% and 33%, respectively. Trial 2 (NCT02793583) is a clinical trial designed for patients with follicular lymphoma.

After 117 eligible subjects were treated with this product, the ORR was 43%, of which CR and PR were 3.4% and 39, respectively. %, the median DOR was 11.1 months.

Marginal zone lymphoma is a very rare non-solid tumor, accounting for about 3% of non-Hodgkin’s lymphoma. The treatment options are relatively limited. The prevalence of follicular lymphoma is slightly higher, accounting for about 3% of non-Hodgkin’s lymphoma. 12%, 14,000 Americans were diagnosed with the disease in 2016.

EVP forecasts 2026 sales of 296 million U.S. dollars.

3) February 12, 2021-Cosela (trilaciclib)-CDK4/6

On February 12, the FDA approved G1 Therap’s CDK4/6 inhibitor to reduce the frequency of bone marrow suppression caused by patients with extensive-stage small cell lung cancer receiving high-dose chemotherapy.

Small cell lung cancer accounts for about 15%-20% of lung cancer, and about 70% of patients are in the extensive stage. Small cell lung cancer is still dominated by chemotherapy. In high-dose chemotherapy, reducing the rate of bone marrow suppression can help patients complete the chemotherapy process. Three clinical trials have proved the efficacy of this product.

In trial one (NCT03041311), 54 patients treated with this product had a duration of severe neutropenia (DSN) of 0 days during the first course of chemotherapy. , While 53 patients who received placebo treatment for 4 days, the proportions of patients with severe neutropenia (SN) in the two groups were 1% and 26%, respectively, reaching the primary endpoint; patients receiving this product in the entire During the course of chemotherapy, the average proportion of patients with dose reduction or adverse reactions per course of treatment was 0.021, while that in the placebo group was 0.085, which also reached the secondary endpoint.

In trial two (NCT02499770) and trial three (NCT02514447), 77 and 61 patients participated in the trial, and the results were similar to those in trial one.

Previously, the FDA has approved three CKD4/6 inhibitors, and the market for breast cancers with HR-positive and HER-negative has been wiped out. EVP predicts that this product will have sales of US$583 million in 2026.

4) May 28, 2021-Truseltiq(infigratinib)-FGFR

Also on May 28, QED Therap’s FGFR (fibroblast growth factor receptor) inhibitor also received FDA approval for the second-line treatment of locally advanced or metastatic cholangiocarcinoma (CCA) with FGFR2 fusion or rearrangement.

In an open-label, single-arm clinical trial (NCT02150967), 108 eligible patients received this product treatment with an ORR of 23%, of which CR and PR were 1% and 22%, respectively, with a median DoR is 5.0 months.

Cholangiocarcinoma is relatively rare. There are approximately 8,000 newly diagnosed patients in the United States each year, and 15% of them have FGFR2 gene mutations.

As the third FGFR inhibitor, this product has limited market potential. EVP predicts that its sales in 2026 will reach 253 million U.S. dollars.

5) May 28, 2021-Lumakras(sotorasib)-KRAS

This product is the third drug approved by the FDA on May 28. This is the first KRAS inhibitor for the second-line treatment of non-small cell lung cancer (NSCLC) with KRAS G12C gene mutation.

In an open-label, single-arm clinical trial (NCT03600883), 124 eligible patients received this product treatment, with an ORR of 36%, of which CR and PR were 2% and 35%, respectively, with a median DoR is 10.0 months.

KRAS is one of the very common proto-oncogenes, 64% of pancreatic cancer, 37% of rectal cancer and one third of NSCLC patients have KRAS mutations. Globally, there are more NSCLCs with KRAS mutations than EGFR and ALK.

EVP predicts that sales in 2026 will reach 1.756 billion U.S. dollars.

6) July 16, 2021-Rezurock (belumosudil)-ROCK2

On July 16, Kadmon Holdings’ Rho-related coiled-coil protein kinase (ROCK2) inhibitor received FDA approval for the third-line treatment of chronic graft-versus-host disease (cGVHD).

In an open-label clinical trial (NCT0364048), 65 cGVHD patients who had previously undergone 2-5 lines of treatment received this product. On the first day of the seventh course of treatment, the overall response rate was 75%. The partial response rate and complete response rate were 69% and 6%, respectively.

cGVHD is a common and fatal complication after hematopoietic stem cell transplantation (HSCT), with an incidence of 30%-70%. cGVHD is a syndrome caused by transplanted immune cells attacking organs, which can lead to fibrosis of various tissues [iii].

According to literature reports, there are about 22,000 long-term survivors of HSCT in North America, and the potential patient population of this product can reach 10,000.

EVP predicts sales in 2026 will reach 863 million U.S. dollars.

7) September 15, 2021-Exkivity (Mobocertinib)-EGFR

On September 15, the FDA accelerated the approval of Takeda’s new EGFR inhibitor for the treatment of non-small cell lung cancer (NSCLC) with EGFR exon 20 insertion mutations.

In an open-label clinical trial (NCT02716116), 114 patients with EGFR exon 20 insertion mutations who progressed after platinum chemotherapy or chemotherapy received this product.

The objective response rate was 28%, and the median sustained response time (DoR ) Was 17.5 months, and 59% of patients had a sustained response time of more than 6 months.

Although a number of EGFR inhibitors have been approved for the market before, they are basically only approved for NSCLC patients with EGFR exon 19 deletion mutations and exon 21L858R mutations, and patients with exon 20 insertion mutations are almost ineffective.

Exkivity is the second specific therapy for patients with positive EGFR exon 20 insertion mutations and the first oral therapy. EVP predicts that sales in 2026 will reach 436 million U.S. dollars.

8) October 29, 2021-Scemblix (asciminib): ABL

On October 29, the FDA accelerated the approval of Novartis’ new BCR-ABL kinase inhibitor asciminib for the third-line treatment of Philadelphia-positive chronic myeloid leukemia (Ph+CML) in the chronic phase.

The accelerated approval of this product by the FDA is based on the early results of an open-label, activity-controlled clinical trial (NCT 03106779). The trial recruited 233 Ph+ CML patients who had previously received two or more TKI treatments, and were given this product or bosutinib at a ratio of 2:1.

The results showed that the molecular biology of the two groups of patients at week 24 The response (MMR) rates were 25% and 13%, and the complete cytogenetic response (CCyR) rates were 41% and 24%, respectively.

Although the BCR-ABL fusion gene is very common in CML, and some ALL, AML (acute myeloid leukemia) and MM patients also carry the gene, as a third-line therapy, the market potential is relatively limited. EVP predicts the product’s sales in 2026 For 279 million U.S. dollars.

Small molecule kinase inhibitors approved by the FDA in 2021

(source:internet, reference only)

Disclaimer of medicaltrend.org