GSK pushes Jemperli into first-line endometrial cancer treatment

- Normal Liver Cells Found to Promote Cancer Metastasis to the Liver

- Nearly 80% Complete Remission: Breakthrough in ADC Anti-Tumor Treatment

- Vaccination Against Common Diseases May Prevent Dementia!

- New Alzheimer’s Disease (AD) Diagnosis and Staging Criteria

- Breakthrough in Alzheimer’s Disease: New Nasal Spray Halts Cognitive Decline by Targeting Toxic Protein

- Can the Tap Water at the Paris Olympics be Drunk Directly?

GSK pushes Jemperli into first-line endometrial cancer treatment

- Should China be held legally responsible for the US’s $18 trillion COVID losses?

- CT Radiation Exposure Linked to Blood Cancer in Children and Adolescents

- FDA has mandated a top-level black box warning for all marketed CAR-T therapies

- Can people with high blood pressure eat peanuts?

- What is the difference between dopamine and dobutamine?

- How long can the patient live after heart stent surgery?

GSK pushes Jemperli into first-line endometrial cancer treatment. It could beyond Keytruda?

Two months earlier than planned, GSK successfully extended Jemperli to the first-line treatment of endometrial cancer patients.

On July 31, the FDA approved this PD-1 inhibitor in combination with chemotherapy (carboplatin and paclitaxel) , followed by a single agent for the treatment of mismatch repair deficiency (dMMR) or high microsatellite instability (MSI-H ) in adult patients with primary advanced or recurrent endometrial cancer.

GSK claims that Jemperli is the first immunotherapy breakthrough in this segment in decades. In a sense, this may also be the key to whether GSK can push Jemperli to the next heavy volume period.

As a PD-1 inhibitor obtained by GSK’s $5.1 billion acquisition of Tesaro in 2018, Jemperli’s status was once quite embarrassing. In that year, Keytruda and O drugs, the first echelon products of PD-1 inhibitors, had been running around for a long time, and successfully entered many markets including China, opening the “golden age” of rapid realization.

In non-small cell lung cancer (NSCLC) , a major cancer that must be fought by the military , GSK is trying to get a piece of the action.

It is a pity that the “head-to-head” research between Jemperli and Keytruda failed, so GSK had to find another way to choose the field of endometrial cancer, which still has room for development.

In April 2021, Jemperli became the seventh PD-1 monoclonal antibody on the US market by virtue of the FDA-approved last-line treatment of adult patients with advanced solid tumors with relapsed dMMR.

However, GSK is somewhat comforted that Jemperli is the first PD-1 therapy in the field of endometrial cancer.

Despite this, the subsequent sales performance of the drug can be described as unsatisfactory, with sales of 21 million pounds in 2022-the Keytruda is 20.937 billion US dollars.

In order to fully take root in the endometrial cancer market, GSK regards first-line treatment as a potential growth inflection point for Jemperli. However, the road to breakthrough was not smooth.

In May, according to the cross-trial review of the latest results of two PD-1 inhibitors, GSK and Merck, in the first-line treatment of endometrial cancer, Keytruda is slightly better, can reduce the risk of death by 46%, and the time required is longer short.

But Keytruda is not perfect. The median follow-up of pMMR patients was only 7.9 months, key to the study’s limitations, the Merck trial researchers cautioned in the NEJM article.

In addition, in dMMR and pMMR patients outside the United States, the performance of the Keytruda group was even worse than that of the chemotherapy group.

According to public data, about 60,000 new cases of endometrial cancer are discovered in the United States every year, and 15% to 20% of them will be discovered at an advanced stage.

Furthermore, dMMR/MSI-H is present in 20% to 29% of all endometrial malignancies.

Perhaps considering the unmet clinical needs, the FDA still accepted Jemperli’s new indication marketing application in June and granted priority review qualification.

From the data point of view, compared with the chemotherapy group, the follow-up time of Jemperli combined with chemotherapy was more than 25 months, and the clinical trial reached the main research endpoint.

In the overall population, the risk of disease progression and the risk of death in the trial group were reduced by 36%; in the dMMR/MSI-H subgroup of patients, the risk of disease progression and death in the trial group were reduced by 72% and 70%, respectively.

Finally, the FDA approved the first-line treatment indication of Jemperli. But at the same time, Jemperli is also limited to the dMMR/MSI-H population.

This undoubtedly limits the development of Jemperli in the endometrial cancer market.

The FDA’s concerns are to be expected. In recent years, the FDA has placed greater emphasis on overall survival data for new cancer drugs. In some cases, the FDA narrowed the scope of relevant therapies—either because overall survival data were immature or because long-term survival data suggested that certain subgroups of patients might be harmed. Jemperli falls into the former category.

In the first overall survival interim analysis of the RUBY trial, Jemperli reduced the risk of death in patients with pMMR/MSS by 27%. But it is clear that the current results in the pMMR/MSS subgroup are not mature enough to convince the FDA.

A GSK spokesman said the RUBY trial is still following patients for more overall survival data, and the company is also in discussions with the FDA about a possible label expansion.

In addition, the second tier of the RUBY trial is testing a “cocktail” regimen. The regimen adds GSK’s PARP inhibitor Zejula to Jemperli and then mixes Jemperli with chemotherapy in first-line endometrial cancer. According to the plan, the data is expected to be disclosed in the first half of 2024.

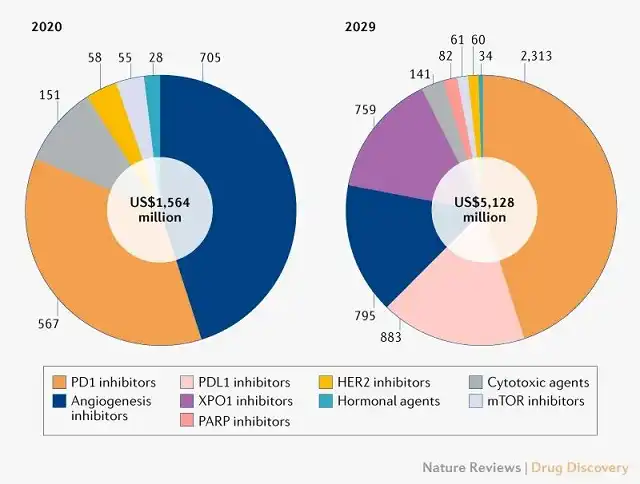

Citing data published by Nature , the endometrial cancer market will increase significantly to US$5.1 billion in 2029. Among them, PD-1/PD-L1 inhibitors will become the leading drug category in sales, and are expected to obtain more than 60% of the market sales in this year, reaching 3.2 billion US dollars.

The huge cake not only attracted Merck and GSK, but MNCs such as Eisai and AstraZeneca are also competing for the first-line treatment of endometrial cancer.

Eisai’s anti-angiogenic targeted drug lenvatinib combined with K drug “Cola Combination” has carried out two major clinical studies in the field of endometrial cancer, namely KEYNOTE-146 and KEYNOTE-775.

In May of this year, AstraZeneca released positive results for the combination of PD-1 monoclonal antibody Imfinzi and PAPR inhibitor Lynparza.

AstraZeneca said Imfinzi, alone or in combination with Lynparza, had less tumor progression than chemotherapy in first-line patients with advanced or recurrent endometrial cancer.

Focusing on the PD-1/PD-L1 track, there are many latecomers who want to fight hand-to-hand with GSK. Competing products including O Drug, Sintilimab, and Camrelizumab have carried out more than ten studies on endometrial cancer patients with advanced second-line and above treatment.

In terms of treatment methods, most of them are combination of target immunity, combination of PARP inhibitors, combination of double immunity and so on.

In the first half of the year, Jemperli brought in £36m in sales for GSK. In addition to the US market, through the Orbis project, Jemperli’s listing application will be simultaneously carried out in Australia, Canada, Switzerland, Singapore and the United Kingdom. At present, the application of the drug in EMA has entered the review stage.

References:

1. GSK beats Merck for first PD-1 approval in newly diagnosed endometrial cancer; fiercepharma

2. GSK’s Jemperli loses initial edge on Merck’s Keytruda; fiercepharma

3. Jemperli (dostalimab) in combination with chemotherapy approved in the US as the first first-line treatment option in decades for dMMR/MSI-H primary advanced or recurrent endometrial cancer | GSK

4. Annual inventory of endometrial cancer immunotherapy progress in 2022; Yuyanjia

5. The endometrial carcinoma market; nature reviews drug discovery

GSK pushes Jemperli into first-line endometrial cancer treatment

(source:internet, reference only)

Disclaimer of medicaltrend.org

Important Note: The information provided is for informational purposes only and should not be considered as medical advice.