FDA Fast Track Designation = Immediate Surge in Stock Prices?

- Why Lecanemab’s Adoption Faces an Uphill Battle in US?

- Yogurt and High LDL Cholesterol: Can You Still Enjoy It?

- WHO Releases Global Influenza Vaccine Market Study in 2024

- HIV Infections Linked to Unlicensed Spa’s Vampire Facial Treatments

- A Single US$2.15-Million Injection to Block 90% of Cancer Cell Formation

- WIV: Prevention of New Disease X and Investigation of the Origin of COVID-19

FDA Fast Track Designation = Immediate Surge in Stock Prices?

- Red Yeast Rice Scare Grips Japan: Over 114 Hospitalized and 5 Deaths

- Long COVID Brain Fog: Blood-Brain Barrier Damage and Persistent Inflammation

- FDA has mandated a top-level black box warning for all marketed CAR-T therapies

- Can people with high blood pressure eat peanuts?

- What is the difference between dopamine and dobutamine?

- How long can the patient live after heart stent surgery?

FDA Fast Track Designation = Immediate Surge in Stock Prices for Companies?

Fast Track Designation (FTD) is a special designation provided by the FDA to expedite the development and approval of new drugs, biologics, or medical devices.

Its purpose is to accelerate the process of bringing products that can address medical needs to market, especially innovative products that have the potential to improve the treatment of significant diseases.

According to a recent study, obtaining FTD has a direct impact on the stock prices of developers, showing a positive correlation.

This clear association is rooted in the belief of investors that FDA’s FTD designation largely signifies product recognition and serves as a protective shield for market entry.

Therefore, in this generally optimistic scenario, the stock prices of developers tend to soar.

Previous Research Findings

Past research has indicated a positive correlation between the grant of FTD and a company’s stock market performance, regardless of the company’s market capitalization.

Cohen’s study examined 24 FTD approvals announced between 1998 and 2003. Researchers found that stock prices on the first day after the FTD announcement often experienced significant increases, with an average gain of up to 19% compared to the first, third, and sixth months before the FTD announcement. Cohen also discovered a negative correlation between market capitalization and stock price gains. In other words, larger pharmaceutical companies experienced smaller stock price increases due to FTD. This suggests that FTD designation has a more significant impact on the stock prices of smaller publicly traded biotech companies.

Alefantis, Kulkarni, and Vora conducted similar research, focusing on 26 FTDs from 1998 to 2001. Their study found an average stock price increase of 10.20% on the first day after the FTD announcement.

Anderson and Zhang examined 107 FTD announcements from 1998 to 2004 and found an average price increase of 10.11%. Their research also supported Cohen’s previous findings that the magnitude of stock price increases is negatively associated with the company’s market capitalization. In other words, FTD designation has a more significant impact on the stock prices of smaller publicly traded companies.

Latest Research Findings

In a recent paper published in Drug Discovery Today by Williamson et al., researchers focused on biotech companies with fewer than 100 employees and a market capitalization of less than $500 million, specifically exploring the patterns of stock price changes after these companies obtained FTD designation.

Researchers selected 25 FTD designations announced by the FDA between June 23, 2019, and June 23, 2020, targeting companies with fewer than 100 employees and a market capitalization of less than $500 million.

The researchers collected data on cumulative average abnormal returns (CAAR) for the five days before and 30 days after the FTD announcement and the three years following the announcement. They aggregated these returns to assess the overall impact of specific events on stock prices.

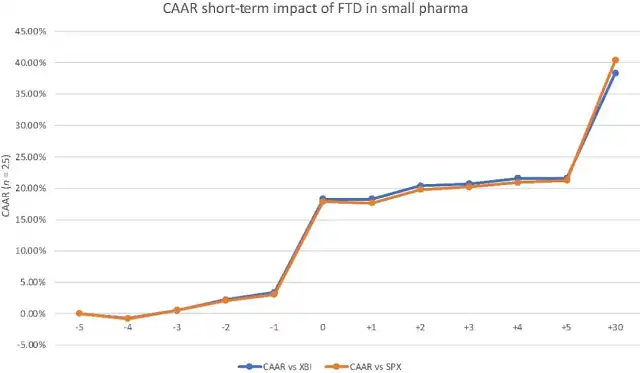

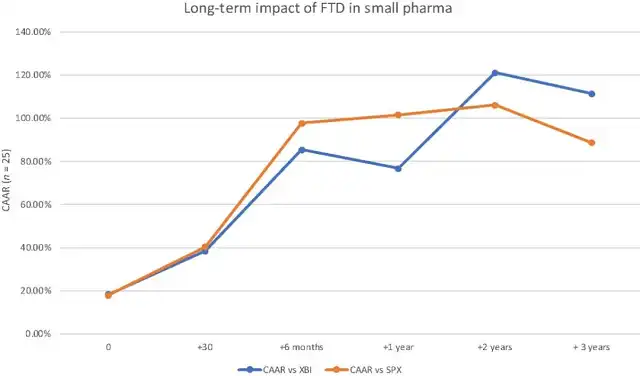

The researchers used the SPDR S&P Biotech ETF (XBI) and the S&P 500 Index (SPX) as benchmarks. XBI reflects the performance of the S&P Biotechnology Select Industry Index, providing insight into industry-specific factors. In contrast, SPX is a broad-market U.S. stock index reflecting more general market trends. This dual benchmark approach ensures comprehensive evaluation, as they respectively address industry-specific and broader market dynamics. CAAR trends for short and long-term windows are shown in Figures 1 and 2.

Figure 1 CAAR trends for biotech and small pharmaceutical companies five days before and after FTD announcements.

Figure 1 CAAR trends for biotech and small pharmaceutical companies five days before and after FTD announcements.

Image Source: Drug Discovery Today

Figure 2 CAAR trends for biotech and small pharmaceutical companies three years after FTD announcements.

Figure 2 CAAR trends for biotech and small pharmaceutical companies three years after FTD announcements.

Image Source: Drug Discovery Today

From Figure 1, it’s evident that biotech companies’ stock prices experienced significant short-term increases after the FDA’s FTD announcement. Compared to the XBI benchmark, the fifth-day CAAR was 21.59%, rising to 38.34% on the thirtieth day. Compared to the SPX benchmark, the fifth and thirtieth-day CAAR were 21.23% and 40.38%, respectively.

Figure 2 shows that after the FTD announcement, small biotech companies’ long-term stock prices may be significantly affected. CAAR shows significant growth at six months, one year, two years, and three years compared to both XBI and SPX benchmarks. These results highlight the critical long-term impact of FTD on the value of small to mid-sized biotech companies.

For the long-term impact on stock prices, FTD is likely not the sole driving force. Other factors, such as FDA’s Breakthrough Therapy Designation (BTD), should play a synergistic role in driving long-term stock price increases.

However, as an early indicator of future stock price trends, FTD may imply positive prospects for subsequent regulatory processes. Therefore, there should be an association between FTD designation and long-term stock value. It’s worth noting that the downward trend in stock prices shown in Figure 2 two years later is related to the negative effects of the Covid-19 pandemic.

Conclusion

Williamson et al.’s latest research, despite its relatively small sample size, provides compelling evidence that FDA’s FTD designation has a critical impact on the stock prices of biotech companies. This study clearly reveals the pattern of significant short-term stock price increases for small and mid-sized biotech companies after announcing FTD. From a long-term perspective, a series of positive factors potentially triggered by FTD, including Breakthrough Therapy Designation and Accelerated Approval, could have a long-term positive impact on stock prices, thereby increasing company market capitalization.

From an investment perspective, investors can potentially gain substantial economic returns by purchasing stocks immediately after the FTD announcement.

FDA Fast Track Designation = Immediate Surge in Stock Prices for Companies?

References:

1. Cohen. F. The Fast Track Effect. Nat Rev Drug Discov. 2004. 3, 293-294.

2. Alefantis, T.G., Kulkarni, M.S., Vora, P.P. Wealth effects of food and drug administration “fast track” designation. J Pharm Finance Econ Policy. 2004. 13, 41-53.

3. Anderson,C.W.,Zhang,Y.Security market reaction to FDA fast track designations.J.Health Care Finance.2010.37,26-47.

(source:internet, reference only)

Disclaimer of medicaltrend.org

Important Note: The information provided is for informational purposes only and should not be considered as medical advice.