2020 Top 10 Global Medical Companies

- Gut Bacteria Enzymes Offer Hope for ABO Universal Blood Transfusions

- Well-Known Japanese Medicine Exposed for 30 Years of Data Falsification

- Oregon Reverses Course: From Decriminalization to Recriminalization of Drug Possession

- Why Lecanemab’s Adoption Faces an Uphill Battle in US?

- Yogurt and High LDL Cholesterol: Can You Still Enjoy It?

- WHO Releases Global Influenza Vaccine Market Study in 2024

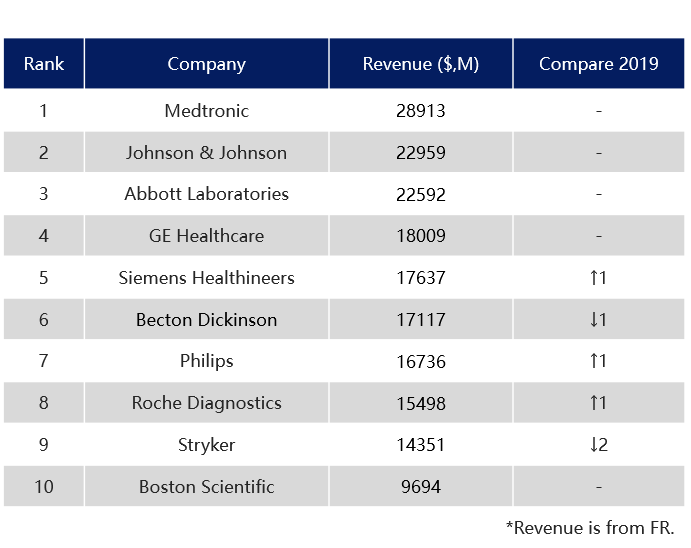

2020 Top 10 Global Medical Companies

2020 Top 10 Global Medical Companies. No one could have imagined that after a year after the outbreak of the COVID-19, we still failed to get back on track.

The new normal under the epidemic has not yet formed. But under the high pressure of the epidemic in the medical device industry, innovation and acceleration have become mandatory topics! Fight against the changing epidemic with speed and passion.

For companies, “business is related to the needs of the COVID-19 epidemic” has become the most important point of performance growth.

COVID-19 virus detection, digital medical treatment, and telemedicine will be fast-forwarded in 2020 and develop rapidly; however, due to the postponement of surgery, orthopedics, cardiovascular and other fields have been greatly affected.

*The exchange rates are all based on the exchange rate on December 25, 2020. Based on the financial report release.

*Medtronic’s fiscal year 2020 period is from April 28, 2019 to April 24, 2020.

*The 2020 fiscal year of BD Medical and Siemens Medical is from October 1, 2019 to September 30, 2020.

In 2020, among the top 10 medical companies in the world, only Abbott, Philips, and Roche Diagnostics will achieve positive growth.

Medtronic, Johnson & Johnson Medical, Abbott, and GE Healthcare still firmly occupy the top 4 positions in the industry. Among them, Abbott has achieved a growth rate of +13% and has secured its position as a “No. 3”, and is only less than US$300 million away from the second-ranked Johnson & Johnson Medical.

Siemens Medical: Through its imaging and clinical treatment business, overall revenue has been maintained, and the ranking has risen by one to occupy the fifth place;

BD Medical: Although benefiting from COVID-19-related needs, such as testing, monitoring, etc., its overall performance is -1%, and its ranking fell by 1 to 6;

Philips: Relying on the high growth in the field of connected care to achieve overall revenue +4%, the ranking rose by one to seventh;

Roche Diagnostics: The COVID-19testing business drove the overall revenue +14%, contributing to the highest growth in the Top10, and the ranking rose by one to eighth;

Stryker: Due to the delay of surgery caused by the COVID-19 test, the ranking dropped by 2 to 9th;

Boston Scientific: All businesses have been adversely affected, revenue -8%, ranking 10th.

1 Medtronic

- 2020 operating income (millions of dollars): 28913

- Revenue in 2020: -5%

- Research and development expenses: 2331 (8% of total revenue)

In fiscal 2020, due to the adverse effects of the exchange rate and the COVID-19 epidemic, Medtronic ushered in the first overall performance decline (-5%) in many years.

Although its financial performance has been challenged, Medtronic still occupies the top position of the medical list with a revenue of 28.9 billion U.S. dollars, opening a gap of nearly 5 billion U.S. dollars from the second-ranked Johnson & Johnson Medical.

Key business performance:

Cardiovascular business accounted for 36%, a decrease of 2% compared to fiscal year 2019; revenue was -9% year-on-year, mainly due to the impact of the epidemic, and the number of operations in Q4 slowed down globally. All segmented businesses are affected by the COVID-19 epidemic, and the heart rhythm and heart failure businesses, which account for the largest proportion of the segmented businesses, have declined particularly significantly (-12%).

The minimally invasive treatment business (Kehui) accounted for 29%, a slight increase; revenue was -2% year-on-year. The main force of historical growth-the innovative surgery business fell 4%; but the respiratory, gastrointestinal and kidney business related to the COVID-19 treatment rose (+4%).

Restorative therapy business accounted for 27%, -6% year-on-year. All business segments are declining, with brain therapy (-1%) being the least affected, and pain therapy (-14%) being the most affected.

Diabetes business accounted for 8%, -1% year-on-year.

Regional aspects:

The US market accounted for 52%, -8% year-on-year; affected by the global outbreak of the epidemic, the four major businesses have declined to varying degrees, with the cardiovascular business suffering the most negative impact (-12%).

Mature markets outside the U.S. accounted for 32%, compared to -4% year-on-year; Diabetes business increased by 10%, and other businesses declined to varying degrees. Regionally, only South Korea’s revenue is growing.

Emerging markets accounted for 16%, -1% year-on-year; diabetes business rose sharply (+12%), minimally invasive treatment business rose slightly (+3%), restorative therapy business remained the same as in 2019, while cardiovascular business declined -5 %.

Medtronic stated in its financial report: For the first nine months ending on January 24, 2020, before the full outbreak of the COVID-19 epidemic, revenue in the U.S. market was +1%, revenue in emerging markets +10%, and revenue in mature markets outside the U.S. It was flat in 2019.

2021 development trend:

Digitization and intelligence have become the core direction of Medtronic. From January to August 2020, Medtronic, which has sufficient cash flow, announced three major acquisitions: Digital Surgery, Medicrea and Companion Medical.

Through the acquisition of Digital Surgery, a leader in the field of surgical artificial intelligence, Medtronic is positioned at the forefront of the surgical field-data and analysis.

The acquisition of Medicrea will incorporate artificial intelligence into the surgical planning of spinal cases.

In terms of diabetes, the acquisition of Companion Medical and its smart pen technology expanded its ecosystem to include the multiple daily injections of the diabetes market.

On June 13, 2020, Medtronic reached an agreement with the global private equity giant Blackstone to obtain an investment of up to 337 million US dollars from the Blackstone Group in the next few years to jointly develop the next generation of diabetes continuous blood glucose monitoring products.

After the end of fiscal year 2020, on April 27, Medtronic officially completed the replacement of global CEOs, and Geoff Martha, the former head of restorative treatment business, officially took office.

He said in the financial report: “Medtronic will continue to supplement our internal organic growth through key acquisitions to promote future growth and sustained revenue growth. At the same time, we are also increasing R&D investment and introducing innovative and disruptive technologies into healthcare. “

2 Johnson & Johnson

- 2020 operating income (millions of dollars): 22959

- Revenue in 2020: -12%

- Group research and development expenses: 12159 (accounting for 15% of the group’s total revenue)

In 2020, Johnson & Johnson’s medical equipment business became the company with the highest decline in the list (-12% year-on-year), and its revenue ranked second in the list. Mainly due to the impact of the COVID-19 epidemic and the delays in orthopedics, vision and other surgeries brought by it, the interventional solution business led by electrophysiological products has slightly increased.

Key business performance:

Surgery business accounted for 36%, -13% year-on-year; both general surgery business (-19%) and advanced surgery business (-6%) were adversely affected and declined. The impetus brought by new products offset a certain amount of Negative impact.

Orthopedics business accounted for 34%, -12% year-on-year; all segments of the business have declined to varying degrees, knee joint business was most affected (-21%), and trauma business was least affected (-4%).

Ophthalmology business accounted for 17%, -15% year-on-year, which is the sector with the largest decline in the performance of Johnson & Johnson Medical Devices; contact lenses/other business fell by 12%, disposable contact lenses ACUVUE OASYS brought certain growth; surgery was delayed during the epidemic As a result, the eye surgery business fell by 25%.

Interventional solutions accounted for 13%, and it was +2% year-on-year. It is the only growth segment of Johnson & Johnson Medical Devices; the growth of atrial fibrillation market share and the market recovery have driven the growth of electrophysiology.

Regional aspects:

The US market accounted for 48%, -11% year-on-year. The intervention solutions business rose slightly (+1%), while other businesses declined.

The international market accounted for 52%, -12% year-on-year. The intervention solutions business rose (+3%), while other businesses declined.

2021 development trend:

*The chart is not drawn to scale; the illustration is intended to visualize the quarterly phased impact of operating sales growth rates in 2021.

Johnson & Johnson said that due to the restoration of medical procedures, surgery can be performed (assuming the COVID-19 epidemic is under control) and the continued promotion of new products, Johnson & Johnson’s medical device sector will show double-digit growth in 2021.

In anticipation of continued mild surgical delays and other conditions, Johnson & Johnson expects that its medical device segment will reach the largest growth rate in Q2.

Johnson & Johnson CEO Alex Gorsky said: “If you think forward in the field of medical equipment, few things represent a long-term transformation in the field than the shift to digitalization and surgical robots. We are building a special digital surgery ecosystem to change The standard of medical care for future generations.”

In January 2021, Johnson & Johnson’s orthopedic surgical robot product VELYS™ was approved by the FDA for marketing.

3 Abbott Laboratories

- 2020 operating income (millions of dollars): 22592

- Revenue in 2020: +13%

- Group research and development expenses: 2,420 (7% of total group revenue)

In this special year of 2020, Abbott Medical has shown a growth rate of up to 13%, ranking third, with a revenue gap of less than $300 million from Johnson & Johnson, which is ranked second.

This is mainly due to the continuous introduction of new coronavirus-related testing products by Abbott Medical.

Key business performance:

The diagnostic business accounted for 43%, an increase of 4 points compared to 2019, +40% year-on-year; mainly driven by 11 virus, antibody, and antigen detection reagents launched by Abbott;

Molecular diagnostics surged +225%, rapid diagnostics business from the acquisition of American Airier surged +113%, contributing as much as $4.4 billion in revenue; traditional diagnostics (-4%) and point-of-care diagnostics (-8%) ) Have different degrees of decline.

The US market is +65% year-on-year, and the international market is +25% year-on-year.

Medical equipment business accounted for 57%, year-on-year -4%; Diabetes business performed well, +30% year-on-year, mainly driven by diabetes care product FreeStyle Libre; Other sub-businesses have continued to decline, and cardiovascular business has declined. Maximum, reaching 18%.

The US market is -8% year-on-year; the international market is basically the same as 2019 year-on-year.

Regional aspects:

he US market revenue was US$9.7 billion, accounting for 43%, or +17% year-on-year, mainly driven by the high growth of the diagnostic business.

The international market revenue was US$12.9 billion, accounting for 57%, which was +10% year-on-year. The growth was also driven by the diagnostic business.

2021 development trend:

On March 31, 2020, Abbott Global President and Chief Operating Officer Robert Ford formally replaced Miles White as Abbott’s CEO.

Robert Ford said that the market environment in 2020 once again convinced him that “the value of a diversified business model”, diversification maximizes Abbott’s growth opportunities. At the same time, Abbott is benefiting from its forward-looking digital layout. In 2021 and beyond, Abbott will continue to expand its digital business, covering areas such as diabetes care, diagnosis and heart failure.

As the COVID-19 epidemic continues until 2021, Abbott plans to strengthen its strategic investments in 2021, such as increasing the production capacity of nCOVID-19 detection and transient glucose monitoring systems, to promote rapid growth in performance. At the same time, Abbott will also focus on expanding its sensing technology to areas other than diabetes and product line innovation, and continue to introduce new products.

4 GE Healthcare

- 2020 operating income (millions of dollars): 18009

- Revenue in 2020: -10%

- Group research and development expenses: 2565 (accounting for 5% of the group’s total revenue)

In 2020, GE Healthcare is -10% year-on-year, ranking fourth in revenue.

Key business performance:

GE’s medical business is mainly divided into two major sectors: Healthcare Systems and Pharmaceutical Diagnostics.

In 2020, in the fields of ventilators, monitors, CT and X-ray machines related to the COVID-19 pneumonia, GE Healthcare has won some orders; and the delay in elective surgery has also brought its drug diagnosis, MR, and ultrasound revenue decline.

GE medical order: revenue of 18.6 billion US dollars, -12% year-on-year, organic +1% year-on-year.

GE medical business profit: 3.1 billion US dollars, -18% year-on-year, organic year-on-year +17%.

GE medical business profit margin: 17%, down 170 basis points.

In 2020, GE Healthcare launched more than 40 new medical products, including the enhanced Mural Virtual Care Solution, which provides a complete view of the patient status in the entire care area, hospital or system.

Regional aspects:

Strong growth in the Chinese and European markets.

The US market was +2% year-on-year, including orders for ventilators from the US government.

Other market revenue changes were not disclosed.

2021 development trend:

GE Healthcare global CEO Kieran Murphy said that the market is returning to a somewhat more stable level, and hospitals are also trying to digest the suppressed demand in the epidemic.

But “I think we have to be cautious about market growth. We will not change our guidelines, that is, to maintain a low to median growth rate in 2021.”

5 Siemens Healthineers

- 2020 operating income (millions of dollars): 17637

- 2020 revenue: flat

- Research and development expenses: 1637 (accounting for 9% of total revenue)

In fiscal 2020, under the influence of the COVID-19 epidemic, Siemens Healthcare’s revenue was $17.6 billion, basically the same as in fiscal 2019. The ranking rose by 1 to 5th.

The small growth in imaging and clinical treatment business was offset by a small decline in the diagnostic field.

Key business performance:

The imaging business accounted for 62%, an increase of 1% compared to 2019, and revenue was +2% year-on-year; as CT scans are becoming more and more important for diagnosing patients who are positive for the new coronavirus, Siemens Medical’s CT business has grown strongly;

Revenue growth in Europe, the Middle East, and Africa was strong, Asia and Australia grew slightly, and the U.S. market declined due to the epidemic.

The diagnostic business accounted for 27%, -5% year-on-year; mainly due to the decrease in routine care during the COVID-19 epidemic; all regions showed a downward trend.

The clinical treatment business accounted for 11%, +1% year-on-year; it was mainly due to the strong growth in the EMEA region; the US market revenue declined slightly.

*EMEA includes Europe, Commonwealth of Independent States, Africa, middle East.

The pre-interest and tax profit margins of Siemens Healthcare’s three major businesses (imaging, diagnosis, and clinical treatment) are 21%, 2%, and 18% respectively. Among them, the EBIT margin of the diagnostic business has fallen sharply compared to the 2019 fiscal year (9%) due to the COVID-19 epidemic, the promotion of Atellcia solutions and the negative impact of foreign exchange.

Regional aspects:

- EMEA market revenue +3% year-on-year, mainly driven by the strong growth of imaging and clinical treatment business;

- Americas (including the United States) market revenue -2% year-on-year, all business segments have a slight decline;

- Revenue in the Asian and Australian markets was -2% year-on-year, with China still growing (+3%).

2021 development trend:

The 2020 fiscal year marks the beginning of the second phase of Siemens Healthcare’s “2025 strategy”, that is, the “upgrade” phase. The company has clarified its priorities for its segments-expanding market share and advancing the company’s digital transformation. This “upgrade” phase will continue until the end of fiscal year 2022. Siemens Medical’s announcement in 2020 to acquire Varian for USD 16.4 billion is based on this strategy.

In the upgrade phase, Siemens Medical’s goal is to increase comparable revenues by more than 5% per year, and its adjusted basic profit per share will increase by about 10% annually. among them,

The imaging business focuses on continuous innovation of core business, expansion of imaging products, and a leading position in AI-assisted clinical decision-making.

The focus of the diagnostic business is to take advantage of the market opportunities provided by the laboratory diagnostic automation trend to elevate the department’s business to a growth level.

The focus of the clinical treatment business is to further develop innovative technologies and services to promote and improve the development of image-guided treatment technologies.

6 Becton Dickinson

- 2020 operating income (millions of dollars): 17,117

- Revenue in 2020: -1%

- R&D expenses: 1096 (6% of total revenue)

In fiscal 2020, BD Medical’s revenue has basically stabilized, -1% year-on-year. The ranking dropped 1 place to 6th.

Key business performance:

The medical sector accounted for 51%, compared to -4% year-on-year; only the drug system maintained growth (+8%); due to the decline in the use of related products globally, especially in the United States, China and Europe, caused by the COVID-19 epidemic, drug delivery solutions year-on-year- 8%; drug management solutions -7% year-on-year, diabetes care -2% year-on-year.

Life sciences accounted for 27%, an increase of 2% compared to fiscal year 2019 and +9% year-on-year, driven by the up to +32% growth of the diagnostic system business, especially the COVID-19-related operations on BD VeritorTM Plus and BD MAXTM platforms Driven by the demand for diagnostic reagents; however, due to the decrease in the demand for routine testing, the pre-analysis system business was -5% year-on-year, and the life science business was -4% year-on-year.

Interventional departments accounted for 22%, and -4% year-on-year, mainly due to the adverse effects of the COVID-19 epidemic; among them, surgical products were -10% year-on-year, and peripheral interventions were -4% year-on-year; while urology and intensive care were +2% year-on-year. Mainly driven by the home care business brought by the COVID-19 and the target temperature management business.

Regional aspects:

- The US market accounted for 57%, and revenue was the same as in fiscal 2019.

- The international market accounted for 43%, -2% year-on-year; of which,

- European market revenue is 3.5 billion US dollars, +4% year-on-year;

- The Greater Asia region (Greater Asia), which includes Greater China, Japan, South Asia, Southeast Asia, South Korea, Australia and New Zealand, has revenue of US$2.6 billion, -6% year-on-year.

2021 development trend:

On January 28, 2020, Tom Polen, former global president and chief operating officer of BD Medical formally succeeded Vincent A. Forlenza as the global CEO and president of BD Medical.

On January 26, 2021, BD Medical announced that Tom Polen will serve as the chairman of the board of directors of BD, succeeding Vincent A. Forlenza, who is about to retire. The appointment will take effect on April 28, 2021.

Tom Polen said: “The COVID-19 pandemic highlights the flexibility and scale of BD Medical. We quickly adjusted to meet the unprecedented demand for COVID-19 treatments such as diagnostic tests, drug delivery solutions, and critical care products.”

For the future, BD Medical will “plan ahead and upgrade the production of injection equipment to meet the global vaccination campaign that is expected to begin soon.”

BD Medical expects its revenue in fiscal 2021 will achieve high single-digit to low double-digit growth, which includes approximately 100 basis points of foreign exchange contribution. At the same time, it is expected that the adjusted diluted earnings per share for fiscal 2021 will be between US$12.40 and US$12.60, a year-on-year increase of 21.5%-23.5%, including approximately 50 basis points of foreign exchange contribution.

7 Philips Healthcare

- 2020 operating income (millions of dollars): 16736

- Revenue in 2020: +4%

- Group research and development expenses: 2336 (10% of the group’s total revenue)

In 2020, Philips Medical’s two core businesses-diagnosis and treatment business, and connected care business, have revenues of $16.7 billion, +4% year-on-year. The ranking rose by one place to occupy the seventh position.

Key business performance:

Philips Medical’s revenue accounted for 70% of the Philips Group’s overall revenue, an increase of 2% compared to 2019.

- Diagnosis and treatment business was -2% year-on-year, mainly driven by the low single-digit growth of imaging diagnosis; affected by the delay of elective surgery, the revenue of image-guided therapy and ultrasound experienced a high single-digit decline;

- Growth regions showed a median growth, mainly driven by double-digit growth in China, Russia, Central Asia, and Central and Eastern Europe; mature regions showed a median decline, with Western Europe experiencing a lower decline and North America with a higher decline.

The connected care business was +22% year-on-year. Driven by the demand for COVID-19 treatment, sleep and respiratory care, monitoring and analysis achieved double-digit growth; all regions also showed double-digit growth.

Regional aspects:

The North American and Western European markets belong to Philips’ first and second largest markets. The diagnosis and treatment business has declined, and the connected care business has increased.

All businesses in the growth regions are showing a growth trend, and the interconnection care business is showing a double-digit growth trend.

2021 development trend:

In 2021, Philips will continue to focus on the medical business. In December 2020, Philips decided to bid and sell its home appliance assets. Philips said: “The spin-off (home appliance business) is in progress and is expected to be completed in the third quarter of 2021. At the same time, Philips retains all potential options, including IPOs.”

Digitization is also Philips’ choice. In August and December 2020, Philips made two acquisitions to strengthen the digitalization of the two major businesses.

In August, it acquired Intact Vascular, a US peripheral vascular company, for US$360 million. This move is intended to expand its peripheral vascular product line and enhance image-guided therapy.

In December, it acquired Biotelemetry, a bio-telemetry technology company, for US$2.8 billion, whose products enable doctors and nurses to provide real-time remote care on the cloud.

In 2021, Philips expects to achieve low-single-digit comparable sales growth, and the adjusted EBITA profit margin will increase by 60-80 basis points. The growth will be mainly due to the strong growth in the fields of diagnosis and treatment and personal health, and the revenue of the connected care business will decline.

8 Roche Diagnostics

- 2020 operating income (millions of dollars): 15498

- Revenue in 2020: +14%

- Research and development expenses: 1784 (12% of total revenue)

In 2020, benefiting from the outbreak of demand for detection reagents for the new coronavirus, Roche Diagnostics has shown a growth of up to +13%, with revenue of $15.5 billion. The ranking rose by one place to occupy the eighth place.

Key business performance:

The central laboratory and the POC diagnostics division accounted for 53%, a decrease of 7 percentage points compared with 2019, and -1% year-on-year. This was mainly affected by the decrease in the amount of routine testing; the sales of SARS-CoV-2 rapid antigen testing were partially offset The decline in routine testing. Europe, the Middle East and Africa (EMEA) skyrocketed (+11%), North America rose slightly (+2%), and other regions fell sharply (-10%).

Molecular diagnostics business accounted for 27%, an increase of 11% compared to 2019, and +90% year-on-year, which was strongly driven by the cobas SARS-CoV-2 PCR test. All regions are growing rapidly.

Organizational diagnosis business accounted for 8%, +5% year-on-year. Mainly driven by sales growth of advanced staining instruments, companion diagnostics, and the recovery of production delays in North America the previous year. Due to the increase in reagent sales in the Asia-Pacific region, revenue was +14%.

Diabetes management business accounted for 12%, -5% year-on-year. Mainly due to the continuous contraction of the blood glucose monitoring market and the impact of the COVID-19 epidemic.

In 2020, Roche Diagnostics’ revenue related to various COVID-19 tests will be US$2.9 billion.

Regional aspects:

- Europe, the Middle East and Africa contributed 40% of revenue, +19% year-on-year;

- The North American market contributed the highest growth, +26% year-on-year;

- Latin America +14% year-on-year; Japan +5% year-on-year;

- The Asia-Pacific region accounted for 23% of revenue, -3% year-on-year, and it was the only region where Roche Diagnostics saw its performance decline. Revenue in the Chinese market was US$2.1 billion, -11% year-on-year.

2021 development trend:

Promoting the innovation of personalized medicine is one of the core strategies of Roche Group in the future.

In the field of digital medical care, Roche Diagnostics has launched digital solutions related to COVID-19 detection (Viewics LabOps COVID-19, etc.) during 2020 to help laboratories improve efficiency.

In 2021, Roche Diagnostics will continue to promote the listing of its equipment.

In 2021, Roche Group expects revenue to grow in the low-medium single-digit range at a constant exchange rate. Under a fixed exchange rate, the growth target of core earnings per share is roughly the same as revenue. Roche expects to further increase its dividend.

9 Stryker

- 2020 operating income (millions of dollars): 14351

- Revenue in 2020: -4%

- Research and development expenses: 984 (7% of total revenue)

In 2020, under the influence of the COVID-19 epidemic, Stryker broke the record of continuous high growth of nearly 10% in the past 7 years, and recorded revenue of 14.4 billion US dollars, -4% year-on-year. The ranking dropped two places to 9th.

Key business performance:

The medical surgery department accounted for 44%, -1% year-on-year; Medical business rose +12%, and Sustainability (-12%), endoscopes (-11%), and instruments (-5%) all declined to varying degrees.

Orthopedics business accounted for 35%, year-on-year -6%; trauma and limbs business maintained growth (+5%); affected by the postponement of elective surgery, knee joints (-14%) and hip joints (-13%) Sub-sectors have fallen sharply.

Neurospine business accounted for 21%, -5% year-on-year; neural business +2% year-on-year, spine business -10% year-on-year.

Regional aspects:

Revenue in the US region -5% year-on-year, orthopedic trauma and limbs business (+8%), medical surgery department’s Medical business (+7%) rose, and other businesses declined.

International revenue was -1% year-on-year. Medical business (+30%) and neurological business (+8%) of the medical surgery department increased, while other businesses declined.

2021 development trend:

Digital healthcare is the direction Stryker is betting on:

On January 5, 2021, Stryker announced the acquisition of OrthoSensor, a leading company in sensor digitization, to bet on orthopedic wearable devices. (Amount not disclosed)

Under the premise that the global economy recovers from the COVID-19 pandemic, Stryker expects organic revenue growth in 2021 to be 8%-10%, and adjusted net income per share in the range of 8.80-9.20 US dollars.

Stryker stated that “will continue to monitor and evaluate the impact of the global response to the COVID-19 pandemic on our business and financial performance.”

10 Boston Scientific

- 2020 operating income (millions of dollars): 9694

- Revenue in 2020: -8%

- Group research and development expenses: 1143 (accounting for 12% of the group’s total revenue)

In 2020, Boston Scientific will be adversely affected by the COVID-19 epidemic, and its medical business revenue will be -8% year-on-year. It still occupies the 10th place, but the revenue gap with the previous one has been widened.

* Boston Scientific’s medical revenue data has excluded the professional pharmaceutical business revenue derived from the acquisition of BTG, which has been sold by Boston Scientific at the end of 2020, and the transaction is expected to be completed in the first half of 2021.

Key business performance:

Cardiovascular business accounted for 40%, -8% year-on-year; peripheral intervention +13%, but interventional heart disease -18%.

Internal medicine and surgery accounted for 32%, -7% year-on-year; the two major segments-endoscopy (-6%), urology and pelvic health (-9%) all showed a downward trend.

Rhythm management and nervous system accounted for 28%, -12% year-on-year, and were the most affected business sectors; all segments of the business experienced double-digit declines.

Regional aspects:

All market segments are in decline, especially Latin America & Canada, with -22% year-on-year; US market -10% year-on-year; EMEA (Europe, Middle East, Africa) year-on-year -7%; APAC (Asia Pacific) year-on-year -6% .

2021 development trend:

Boston Scientific expects that the number of surgeries in 2021 will rebound, but the company will not provide guidance for 2021 performance at this time.

Mike Mahoney, CEO of Boston Scientific, said that given the market environment, it is expected that the performance of last year will be basically reproduced in the first quarter of this year, some “weak”, and it will gradually pick up in the second quarter and return to normal levels in the second half of the year.

In terms of capital allocation, strategic integration remains Boston Scientific’s “primary task”, which focuses on similar high-growth markets. As of the end of 2020, Boston Scientific has $1.9 billion in cash. The company will continue to actively participate in the venture portfolio.

The promotion of digital medical field:

In January 2021, Boston Scientific announced that it would acquire Preventice Solutions, a cardiac monitoring company, for US$925 million.

A report by the consulting firm Ernst & Young predicts that mergers and acquisitions in the medical field will increase significantly in 2021, as the financial strength of the company has reached a record of approximately US$500 billion.

In just one month in 2021, a series of mergers and acquisitions have occurred in the medical device industry.

With the continuation of the COVID-19 epidemic, will medical giants holding large amounts of money make large-scale mergers and acquisitions?

The day when large-scale mergers and acquisitions appear is when the rankings change.

(source:internet, reference only)

Disclaimer of medicaltrend.org