EU warned of the risk of cancers: Pfizer quit GLP-1 weight-loss drug

- Normal Liver Cells Found to Promote Cancer Metastasis to the Liver

- Nearly 80% Complete Remission: Breakthrough in ADC Anti-Tumor Treatment

- Vaccination Against Common Diseases May Prevent Dementia!

- New Alzheimer’s Disease (AD) Diagnosis and Staging Criteria

- Breakthrough in Alzheimer’s Disease: New Nasal Spray Halts Cognitive Decline by Targeting Toxic Protein

- Can the Tap Water at the Paris Olympics be Drunk Directly?

EU warned of the risk of cancers: Pfizer quit GLP-1 weight-loss drug

- Should China be held legally responsible for the US’s $18 trillion COVID losses?

- CT Radiation Exposure Linked to Blood Cancer in Children and Adolescents

- FDA has mandated a top-level black box warning for all marketed CAR-T therapies

- Can people with high blood pressure eat peanuts?

- What is the difference between dopamine and dobutamine?

- How long can the patient live after heart stent surgery?

EU warned of the risk of cancers: Pfizer quit GLP-1 weight-loss drug.

The research progress of the GLP-1 (glucagon-like peptide-1) weight-loss drug that has exploded this year has recently encountered a double storm.

On June 26, Pfizer (PFE.US) announced that it would terminate the development of the oral GLP-1 candidate drug Lotiglipon (once a day).

Pharmacokinetic data from action studies, and transaminase elevations measured in Phase 1 studies and ongoing Phase 2 studies.

Perhaps affected by the above news, Pfizer’s stock price fell by 5.59% on the 26th, approaching the bottom of $35.9 on April 9, 2021, and finally closed down 3.68% to $36.89 per share.

This isn’t the first GLP-1 drug to be discontinued. Also in June, AstraZeneca (AZN.US) terminated the clinical development of its oral GLP-1 candidate drug AZD0186 because its efficacy and tolerability were not better than other drugs currently under development or already on the market.

In April of this year, AstraZeneca announced that it would abandon the GLP-1/GCGR dual-target agonist Cotadutide, which had entered Phase 2b/3, because relevant data showed that the drug was comparable to another marketed drug in terms of hypoglycemic and weight loss. Compared with the GLP-1 drug liraglutide, it did not show more obvious advantages.

Due to its great prospects in reducing blood sugar, weight loss, and non-alcoholic fatty liver, GLP-1 drugs have become star products that the global pharmaceutical industry is paying attention to. The termination decision of the pharmaceutical giant undoubtedly poured cold water on the GLP-1 track, but the popularity of the GLP-1 weight loss track has not diminished.

At the 83rd Annual Scientific Meeting of the American Diabetes Association (ADA) held from June 23rd to 26th local time, Novo Nordisk, Eli Lilly, Boehringer Ingelheim, Hengrui Medicine, First Vita Biotech, etc. Pharmaceutical companies have shown positive data related to weight loss, and the global competition in the field of GLP-1 is still going on.

The highest weight loss in one year was 24.2%, and many pharmaceutical companies announced the weight loss data of GLP-1 drugs

GLP-1 drugs were originally used for the treatment of diabetes. Since the obesity indication of Novo Nordisk GLP-1 receptor agonist liraglutide was approved in the United States in 2014, its weight loss prospects are highly anticipated.

As one of the top academic feasts in the field of diabetes in the world, this year’s ADA annual meeting has attracted a lot of attention on the data related to weight loss of various GLP-1 drugs at home and abroad.

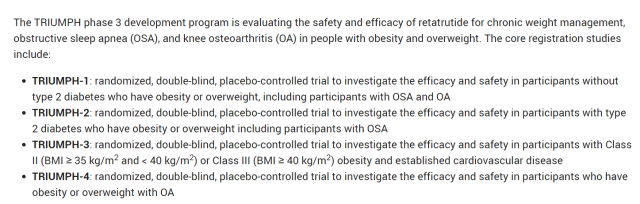

On June 26, local time, Eli Lilly (LLY.US) announced that the phase II study data of its experimental drug retatrutide were released at the ADA annual meeting, showing that at 24 weeks, retatrutide (1 mg, 4 mg, 8 mg or 12 mg) met the primary endpoint of the efficacy assessment in obese or overweight participants without diabetes, with a mean weight loss of 17.5%.

Among the secondary endpoints, mean weight loss was 24.2% at the end of 48 weeks of treatment. Retatrutide is Lilly’s investigational agonist targeting glucose-dependent insulinotropic polypeptide, glucagon-like peptide 1 and glucagon receptor.

The data of 24.2% weight loss in one year is currently the most obvious weight loss effect of various GLP-1 drugs.

In addition to retatrutide, Eli Lilly’s GIP/GLP-1 receptor agonist tilpoetide is at the forefront in the field of weight loss.

On April 27, Eli Lilly announced that the results of the SURMOUNT-2 study showed that Tilpootide (10 mg and 15 mg) achieved a weight loss effect superior to that of placebo in the 72-week study. The reduction was as high as 15.7%.

Novo Nordisk has already made a lot of money from the GLP-1 drug sameglutide injection for weight loss indications.

The company and Eli Lilly have been in a stalemate in the competition for weight loss indications. During the ADA annual meeting, Novo Nordisk He Nordisk (NVO.US) announced the research progress of the oral version of sameglutide.

According to Reuters, Novo Nordisk said on June 25 that the results of clinical trials showed that subjects who received a 50 mg dose of oral version of semaglutide lost an average of 15.1% of their body weight over 68 weeks, compared with previous studies.

Novo Nordisk said it plans to apply to European and American regulators for the drug’s listing later this year.

For patients, oral drugs are more convenient to use than injections and have better compliance.

If they can be marketed first, Novo Nordisk’s position in the field of weight loss will be more stable.

In addition, the Phase II study data of the glucagon/GLP-1 receptor dual agonist survodutid jointly developed by the German company Boehringer Ingelheim and Zealand Pharma was released at the conference, showing that patients who received 46 weeks of treatment without type 2 diabetes In overweight or obese subjects, survodutide was more effective than placebo.

Up to 40% of subjects in the two highest dose groups treated with survodutide lost at least 20% of their body weight.

In the survodutide 4.8 mg dose group, the proportion of subjects who lost 15% or more of their body weight was 67%.

GLP-1 research and development cold thinking: competition is fierce, and the risk of thyroid cancer cannot be ignored

In 2022, global GLP-1RA sales will exceed US$22 billion. Faced with such a huge market prospect, even if the research and development of a certain drug is terminated, pharmaceutical companies have not completely given up the layout of the GLP-1 pipeline.

At the same time that Pfizer officially announced the termination, it also stated that it will continue to advance the clinical development plan of another twice-daily oral GLP-1 agonist Danuglipron, and is also developing a once-daily oral version of the drug.

AstraZeneca’s product pipeline still includes GLP-1 drugs, including the once-weekly GLP-1R/GCGR dual agonist AZD9550.

Some people in the pharmaceutical industry told The Paper that the termination of several drugs will not negate the value of a large class of drugs, but to some extent, this basin of “cold water” has allowed pharmaceutical companies and the entire industry to view GLP more rationally- Class 1 drugs should be carefully deployed to avoid entering the “involved” situation of PD-1 tumor drugs.

The positive weight loss effect is the confidence of GLP-1 research and development companies, but for patients, the safety of this type of drug should still be cautious.

Recently, the European Medicines Agency (EMA) suggested that GLP-1 drugs may have the risk of thyroid cancer, requiring relevant pharmaceutical companies to submit more information before July 26. The EMA also said it had stepped up scrutiny of GLP-1 treatments.

This risk alert affects Novo Nordisk, Eli Lilly, AstraZeneca, Sanofi and many other pharmaceutical companies, and the indications include diabetes and weight loss.

EMA said that whether GLP-1 drugs used for weight loss also increase the risk of thyroid cancer when used by diabetic patients still needs to be proved by trials.

Novo Nordisk is currently the only company with GLP-1 drugs for weight loss indications. Regarding the above risk warnings, the company responded that the safety data from trials and post-marketing monitoring did not find a causal link between the drug and thyroid cancer , has received a request from the European Medicines Agency for information on the drug and will conduct a thorough review of all relevant data on the issue.

In fact, thyroid cancer risk is not a new concern.

Taking Novo Nordex Meglutide as an example, its instructions list 9 major types of adverse reactions, involving the immune system, nervous system, and gastrointestinal system.

When the FDA approved the drug’s weight-loss indication, it also specifically reminded that the drug’s prescribing information contained a boxed warning to inform medical professionals and patients of the potential risk of thyroid cancer.

In addition, the drug should not be used in patients with a personal or family history of medullary thyroid cancer.

Previously, some doctors also emphasized to The Paper that GLP-1 drugs are prescription drugs, and patients need to be evaluated before using them.

There are also contraindications to their use, such as patients with a history of medullary thyroid cancer or family history. , and patients with type 2 multiple endocrine neoplasia are not recommended.

The above-mentioned people in the pharmaceutical industry believe that the risk of new drug research and development has always been extremely high. Weight-loss drugs have certain consumption attributes and a large audience.

In addition to effectiveness, safety cannot be ignored. These require pharmaceutical companies to rely on solid research results to prove .

EU warned of the risk of cancers: Pfizer quit GLP-1 weight-loss drug

(source:internet, reference only)

Disclaimer of medicaltrend.org

Important Note: The information provided is for informational purposes only and should not be considered as medical advice.