Market analysis of therapeutic monoclonal antibody products

- Gut Bacteria Enzymes Offer Hope for ABO Universal Blood Transfusions

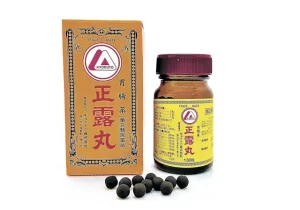

- Well-Known Japanese Medicine Exposed for 30 Years of Data Falsification

- Oregon Reverses Course: From Decriminalization to Recriminalization of Drug Possession

- Why Lecanemab’s Adoption Faces an Uphill Battle in US?

- Yogurt and High LDL Cholesterol: Can You Still Enjoy It?

- WHO Releases Global Influenza Vaccine Market Study in 2024

Market analysis of therapeutic monoclonal antibody products

- Was COVID virus leaked from the Chinese WIV lab?

- HIV Cure Research: New Study Links Viral DNA Levels to Spontaneous Control

- FDA has mandated a top-level black box warning for all marketed CAR-T therapies

- Can people with high blood pressure eat peanuts?

- What is the difference between dopamine and dobutamine?

- What is the difference between Atorvastatin and Rosuvastatin?

- How long can the patient live after heart stent surgery?

Market analysis of therapeutic monoclonal antibody products.

The commercial development of therapeutic monoclonal antibodies (MAbs) began in the early 1980s.

By 1986, the United States approved the first MAb product: muromonab-CD3 (trade name Orthoclone OKT3, Janssen-Cilag) for the prevention of renal transplant rejection disease.

Since approval, therapeutic monoclonal antibodies and antibody-related products (such as Fc fusion proteins, antibody fragments and antibody-drug conjugates) (collectively referred to as “monoclonal antibody products” in this article) have grown into the biopharmaceutical market The dominant product category.

They have been approved for the treatment of many diseases, from thousands of patients or some rare diseases (for example, orphan indications such as hemophagocytic lymphohistiocytosis) to hundreds of thousands of diseases (for example, certain cancers) And multiple sclerosis) or even millions (disease, such as asthma and rheumatoid arthritis).

With the latest approval of MAb products for infectious diseases (such as diseases related to Clostridium difficile, anthrax and human immunodeficiency virus (HIV) infection), the potential of MAb products against coronavirus diseases is very advantageous. However, there is still some debate about how useful any antibody therapy can play in the treatment of COVID-19.

Market growth

Until the end of the 1990s, after the first batch of chimeric antibodies were approved, the approval of sales and other monoclonal antibody drugs was slow.

With the approval of such products, and subsequent approval of humanized antibodies and fully human antibodies, the product approval rate and sales rate of MAb products have risen sharply.

In 2019, the global sales revenue of all monoclonal antibody drugs was close to US$163 billion, accounting for approximately 70% of the total sales of all biopharmaceutical products (approximately US$230 billion).

Since 2013, this value is 75 billion US dollars. The sales of currently approved MAb products continue to grow, and there are more than 1,200 MAb product candidates currently under development, many of which are used for multiple indications, which will further increase the sales of MAb products in the next few years and continue to promote all biopharmaceuticals The overall sales of the product.

As shown in Figure 1 below, in the United States and Europe, the number of monoclonal antibody products approved for commercial sales has increased significantly, with three to five new products approved each year from 2010 to 2014, and then from 2015 to 2019 Ten to 19 new products are approved every year.

Although a total of 139 MAb products have been approved in Europe and the United States since 1985, 14 products have been withdrawn for various reasons.

There are currently 125 approved MAb products on the market. As of August 27, 2020, only six of these products are expressed by microbial systems, while the remaining 119 are produced by mammalian cells.

Five of the six microbial products are antibody fragments, including a fragment conjugate; similarly, full-length monoclonal antibodies expressed in a microbial system (Pichia pastoris) were approved for the first time this year.

Lundbeck Seattle BioPharmaceuticals’ Vyepti (eptinezumab-jjmr) has been approved for migraine prevention.

Given that a large number of drug candidates are currently being developed, we expect the number of MAb products approved each year in the next few years will be similar to the number approved in the past few years.

In fact, as of August 27, 2020, nine MAb products have received the first batch of approvals this year, including the first MAb biosimilars developed and produced from China: Zercepac trastuzumab and Accord Healthcare.

Currently, 21 monoclonal antibody products are undergoing regulatory review, and it is expected that at least two of them will be approved by the end of this year.

Based on the conservative approval rate of 10 products per year, we predict that there will be 180 or more MAb drugs on the global market in 2025.

In addition, we predict that certain COVID-19 MAb products will be included in these predicted products next year.

But they have not yet reached the regulatory review stage of the biological license application (BLA) or market license application (MAA).

Based on the number of new monoclonal antibody products being developed for COVID-19, accelerating the timeline of those higher priority drugs, and the possible use of MAb products as a stopgap before the vaccine is successful.

Projects that have been launched, we predict will be approved 2 to 4 new monoclonal antibody products specifically related to COVID-19.

As shown in Figure 2 below, most of the 119 monoclonal antibody products expressed in mammalian systems are full-length naked monoclonal antibodies (60%), followed by biosimilar full-length naked monoclonal antibodies (19%) .

The other six types of antibody products account for the remaining 21% of the MAb products expressed by mammals.

In the past five years, global sales of MAb products have grown faster than all other biopharmaceutical product categories.

Figure 3 below shows the sales details based on product type (for example, full-length antibody, antibody conjugate, fragment, etc.) and production system (mammalian cell culture or microbial fermentation).

The data shows that the sales of all monoclonal antibody products (regardless of the production system or type) have increased from US$84 billion in 2014 to nearly US$163 billion in 2019, an increase of 93%.

In contrast, the sales of other recombinant protein therapies during the same period hardly changed (approximately US$68 billion).

With the increase in sales of monoclonal antibody products, the total amount of these products produced each year has increased to meet market demand. In 2019, nearly 25 metric tons of monoclonal antibody products were produced globally.

Regardless of the expression system, all other recombinant protein products were approximately 11 metric tons.

The demand for mammalian-expressed monoclonal antibody products has led to a large amount of global production capacity being put into production, and a large amount of investment has been made to improve the design and optimization of methods and approaches for monoclonal antibody production.

In 2019, 36 of MAb products achieved annual sales of more than 1 billion U.S. dollars, of which five products had sales of more than 7 billion U.S. dollars: AbbVie’s Humira (adalimumab), Merck’s Keytruda (pembrolizumab), Regeneron’s Eylea (aflibercept), Bristol-Myers Squibb’s Opdivo (nivolumab) and Genentech/Roche’s Avastin (bevacizumab).

AbbVie (AbbVie) recorded Humira’s sales of approximately $19 billion for two consecutive years, becoming the highest-selling (biological) drug.

Based on the review of historical sales data collected in the proprietary bioTRAK database, the company’s annual report and sales forecast data, we have determined the five-year compound annual growth rate (CAGR) of the monoclonal antibody product market to be 14.1% and forecast the next few years , The market is expected to continue to grow at a compound annual growth rate of 10% or higher.

With a growth rate of 10%, the sales of currently approved monoclonal antibody products and the sales of new products approved in the next few years will drive global sales of monoclonal antibody products to approximately US$240 billion by 2023 and nearly US$240 billion by 2025. US$315 billion.

Factors driving market growth

With the increase in the approval of monoclonal antibody drugs (Figure 1 above), as well as the demand for such products and the revenue generated (Figure 3 above), companies are still very interested in developing them.

There is no specific reason for the increase in the approved volume or increase in such products, but several contributing factors have created an environment conducive to the rapid expansion of the number of approved MAb drugs.

A large amount of funds, the continuous advancement of MAb technology, the expansion of MAb products into new markets, and the emergence of biosimilars have all contributed to almost all MAb products being produced, thereby driving regulatory approvals, broadening the scope of the market, and increasing The income product of the product.

Between 2015 and 2018, fundraising through venture capital, initial public offerings (IPOs) and follow-up activities surpassed this type of fundraising in 2010-2014, and provided financial resources to improve our understanding of diseases at the molecular level stand by.

Although failing to meet the initial expectations of some observers, genomics, proteomics, and other systems biology tools do provide important new targets for regulating disease. MAb products usually provide the most direct way to activate, inhibit or block the clinical proof of concept of these new targets.

The timetable for the development of lead products for investigational new drug applications (IND) has been shortened, while the production timetable for clinical products has been extended.

MAb products and industry technologies have also expanded product types from basic “naked” MAbs to more complex structures, such as providing conjugates targeting cytotoxic or radiological materials and bispecific antibodies that can bind multiple targets.

Since most MAb products are easily discovered and manufactured using platform-based efficient meth

ods, and because antibodies are usually well tolerated and highly specific, there is a risk of accidental safety issues in clinical trials of human MAb products Lower than many other types of treatment products.

Therefore, for many novel targets, MAb products are usually the first product candidates to enter clinical research. If the initial proof-of-concept results are successful, these products will be quickly commercialized.

On the whole, the global market expansion of the pharmaceutical market has also promoted the growth of monoclonal antibody product sales, which is due to the growth and aging of the global population and the improvement of living standards in emerging markets.

In addition, the continuous evaluation of MAb products for new and expanded clinical indications will contribute to the demand for clinical research materials and subsequent sales of newly approved indications.

As the biopharmaceutical industry continues to mature, the number and types of diseases that use monoclonal antibody products for economic treatment will increase.

Part of the reason is the need to cost-effectively provide a large number of products for cost-sensitive indications such as rheumatism and asthma. The latest improvements in MAb production technology have increased process yields and greatly reduced actual manufacturing costs.

As a result, these products have more and more opportunities to penetrate into cost-sensitive indications and markets.

As the patents that provide exclusive rights to many high-profile blockbuster MAb products expire, interest in the development of biosimilars has also grown (Figure 2 above).

In September 2013, the first batch of biosimilar monoclonal antibodies-sold under the trademarks of Remsima (sold by Celltrion) and Inflectra (sold by Pfizer)-were approved for commercial sale in Europe.

These biosimilar versions of Janssen’s blockbuster MAb product Remicade (infliximab) are the first of 32 MAb generic products currently approved, and more biosimilars will definitely be approved in the next few years. Generic MAb products are commercially sold in the United States and Europe.

Biosimilars have received widespread attention in the media and are often discussed as an auxiliary means to reduce the cost of healthcare and more and more patients can receive the required treatment.

However, these products actually represent only a small part of the development process.

However, we expect that as biosimilars gain market acceptance, sales growth of all monoclonal antibody products will moderately accelerate. Interest in them continues to surge in markets in Latin America, China, Southeast Asia, India, and Russia. Several such products have been approved in these regions.

The introduction of biosimilars in these markets may have a significant impact on the global sales of MAb products, because biosimilar MAbs have been approved in regions where expensive innovative products are currently not available.

Bright future

Monoclonal antibody products will continue to be the dominant treatment for a wide range of diseases in the foreseeable future.

The potential impact of MAb therapeutics in the race to establish a COVID-19 vaccine treatment is uncertain. However, despite the ongoing epidemic, global approvals and sales of monoclonal antibodies will continue to increase in the next five years.

With the approval of biosimilar products initially entering the market of monoclonal antibody innovators, the adoption of biosimilars is expected to increase the overall usage rate of antibody product types, thereby bringing the total number of patients (hence, sales) to the segment of the biopharmaceutical industry increase.

The manufacturing capacity to manufacture such products is also constantly expanding to meet the growing demand.

Market analysis of therapeutic monoclonal antibody products

(source:internet, reference only)

Disclaimer of medicaltrend.org

Important Note: The information provided is for informational purposes only and should not be considered as medical advice.